Realty Watch

Indian Real Estate Sector | April 2022

Sector Trend: Shifting preferences and pent-up demand powering home sales in India

Policy Support

The Reserve Bank of India slashed repo rates to a historic low (4%) in 2020 which manifested into low mortgage rates. Joining the bandwagon in inducing more demand were the state governments. The government of Maharashtra reduced stamp duty rates on home sales from 5% to 2% in 2020. The rates were later lifted to 3% till March 2021. Similarly, the Government of Karnataka reduced the stamp duty rates from 5% to 3% in 2020 for properties up to Rs. 35 lakhs. This amount was later increased to Rs. 45 lakhs. The Delhi Government lowered circle rates by 20% to boost housing sales in 2020. Such initiatives helped the sector ride out the storm of uncertainties. These measures were further instrumental in blunting the blow of the new wave of lockdowns due to the Omicron variant in the last quarter of 2021.

Besides lowered interest rates and stamp duty rates, several other initiatives were taken by the Government of India to help the sector revive including the following:

Given the capital-intensive nature of the sector, funding is an important aspect affecting profitability. However, it remains a key challenge for many small developers. To ease the funding risks faced by small developers, the Government announced setting up of a SWAMIH (Special Window for Completion of Construction of Affordable and Mid-Income Housing Projects) fund in 2019. With an allocation of $3.5 billion, this fund aims to complete the construction of stalled housing projects.

The rapid pace of urbanization has led to an increasing demand for affordable housing across metro cities. The completion of 80 lakh homes under Pradhan Mantri Awas Yojana (PMAY), and the allocation of Rs. 48000 crores for the same would help meet this demand.

- Given the capital-intensive nature of the sector, funding is an important aspect affecting profitability. However, it remains a key challenge for many small developers. To ease the funding risks faced by small developers, the Government announced setting up of a SWAMIH (Special Window for Completion of Construction of Affordable and Mid-Income Housing Projects) fund in 2019. With an allocation of $3.5 billion, this fund aims to complete the construction of stalled housing projects.

- The rapid pace of urbanization has led to an increasing demand for affordable housing across metro cities. The completion of 80 lakh homes under Pradhan Mantri Awas Yojana (PMAY), and the allocation of Rs. 48000 crores for the same would help meet this demand.

Business consolidation

Strong demand was seen for large and established developers with a good track record of handling complex and large projects. In Q3 FY21, the top 10 listed realty players saw a 61% year-on-year growth in sales, as reported by rating agency ICRA. The fortunes of these large developers have been growing in sync with the rise in home demand in India. HURUN India Real Estate Rich List (2021) indicates there were 12 Real Estate billionaires in India in 2021, compared to 5 just five years ago. At a time when this count is declining in major economies like USA and China, Indian developers are witnessing a significant rise in wealth creation. The report also identifies that 46% of real estate wealth is concentrated in Western India followed by 29% in South India and 25% in North India. To this extent, it will not be incorrect to say that Covid hastened the speed of consolidation within the Real Estate sector.

Micro-markets

- Bengaluru and Hyderabad sales rose the most and the demand came mostly from the IT sector, which remained unaffected even amidst the second and third waves.

- A dip in rentals was observed in 2021 across most metro city markets. It is, however, likely to be a temporary decline as the gradual opening of offices would lead to a rise in pent- up demand across the working population.

- Hyderabad was the best performing residential market in 2021. In Hyderabad, the average price per square meters remained unaffected while sale of housing units was at 12, 344 in H2 2021 and 6357 in Q4 2021.

- In the Mumbai Metropolitan Region, despite a discontinuation of stamp duty waiver by the state government, increasing affordability, changing consumer perspectives and

- Competitive developer discounts led to a growth in the year-on-year sales in H2 2021 (14%).

- In the National Capital Region, while the prices remained flat in the year 2021, home sales were up by 73% compared to FY2020.

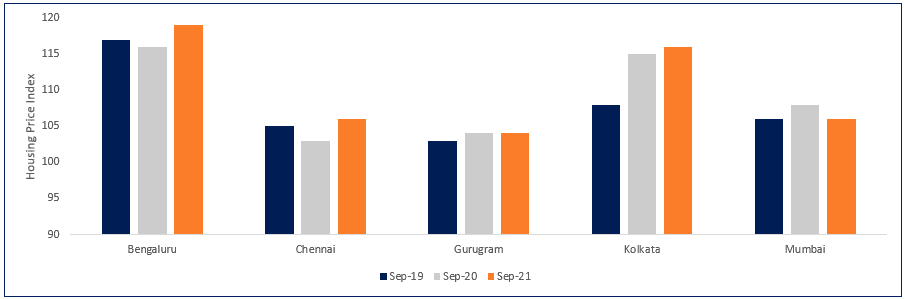

The positive trend was complimented with a marginal price rise across major micro markets (ex Mumbai) boding well for developers’ profit margins (Chart 1).

Chart 1: Housing Price Index (NHB)

Financial trends

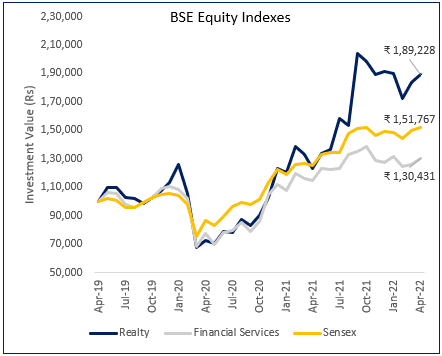

The positive outlook on Indian realty sector is reverberated in market sentiments as well. The CAGR of BSE Realty Equity Index (24.50%) surpassed that of the BSE Sensex (16.18%) from FY19 to FY22.

Listed real estate stocks were one of the best performers during the stressed COVID period. The chart below tracks the value of Rs 1,00,000 invested in BSE Realty Index, Financials Index and Sensex. The Realty Index returns outperformed financial services as well as the broader large cap stocks (chart 2).

Chart 2: Value of Rs 1 lakh invested in Apr’19:

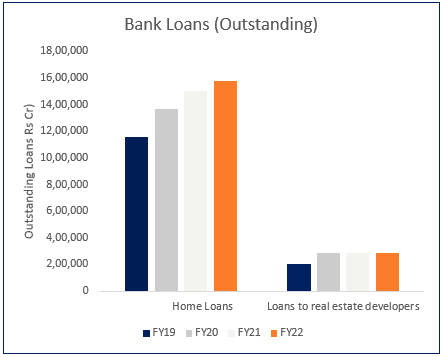

Chart 3: Bank credit to RE sector

On the debt side, large developers continued to get access to bank credit at pre-covid levels. Rising demand also led to a steady pickup in home loan offtake from commercial banks over the last 3 years (chart 3).

Outlook

Amidst the prevailing global inflationary trends, the government’s “growth first” stance is likely to wane, and policy and home loan rates are expected to rise going forward. The sector is also plagued by global inflationary pressures like every other sector currently. Raw materials prices have witnessed a sharp spike in recent times owing to supply chain bottlenecks, sharp rise in demand as well as production impediments rising from the Russia and Ukraine conflict. For example, the CAGR of wholesale prices of key raw materials used in the construction of homes, like cement, steel and paints were 3%, 9% and 6.5% respectively, for the period FY19 to FY22. Consequently, developers are likely to pass on some of these input cost pressures to end consumers. An increasing number of reputed developers have already started doing this and this will gather further momentum as interest rates also start to rise. So far, developers like Godrej, Oberoi and DLF are reported to have been passing on this cost increase to homebuyers.

Despite price and rate pressures, we feel that the strong home ownership sentiment is likely to stay unabated and will not dent the profitability of developers. We therefore expect the overall growth of the sector to remain positive in FY23 as well.

Source:

https://www.crisil.com/mnt/winshare/Ratings/RatingList/RatingDocs/HiranandaniPropertiesPrivateLimited_December%2024,%202021_RR_277849.html

https://www.crisil.com/mnt/winshare/Ratings/RatingList/RatingDocs/Hiranandani_Properties_Private_Limited_October_31_2020_RR.html

https://www.icra.in/Media/OpenMedia?Key=def64afa-b2fd-45a2-8e73-90d43fe43f68

National Housing Bank

BSE India

TruQuest is knowledge series launched by TruBoard Partners providing succinct updates and views on:

- Liquidity outlook

- India’s macro economic view

- Trends within the infrastructure, Real Estate and Renewable Energy sectors

- Impact analysis of new regulations and policies on lending and capital flow

Authors:

Debopam Chaudhuri, Head of Research and Ratings

Ria Rattanpal, Research Associate

+91-9819239926, dc@truboardpartners.com

Authors:

Debopam Chaudhuri, Head of Research and Ratings

Ria Rattanpal, Research Associate

+91-9819239926

dc@truboardpartners.com

Disclaimer

The data and analysis covered in this report of TruQuest has been compiled by TruBoard VT Pvt Ltd and its associates (TruBoard) based upon information available to the public and sources believed to be reliable. Though utmost care has been taken to ensure its accuracy, no representation or warranty, express or implied is made that it is accurate or complete. TruBoard has reviewed the data, so far as it includes current or historical information which is believed to be reliable, although its accuracy and completeness cannot be guaranteed. Information in certain instances consists of compilations and/or estimates representing TruBoard’s opinion based on statistical procedures, as TruBoard deems appropriate. Sources of information are not always under the control of TruBoard. TruBoard accepts no liability and will not be liable for any loss of damage arising directly or indirectly (including special, incidental, consequential, punitive or exemplary) from use of this data, howsoever arising, and including any loss, damage or expense arising from, but not limited to any defect, error, imperfection, fault, mistake or inaccuracy with this document, its content.