RBI Directions on Credit Derivatives

Overview

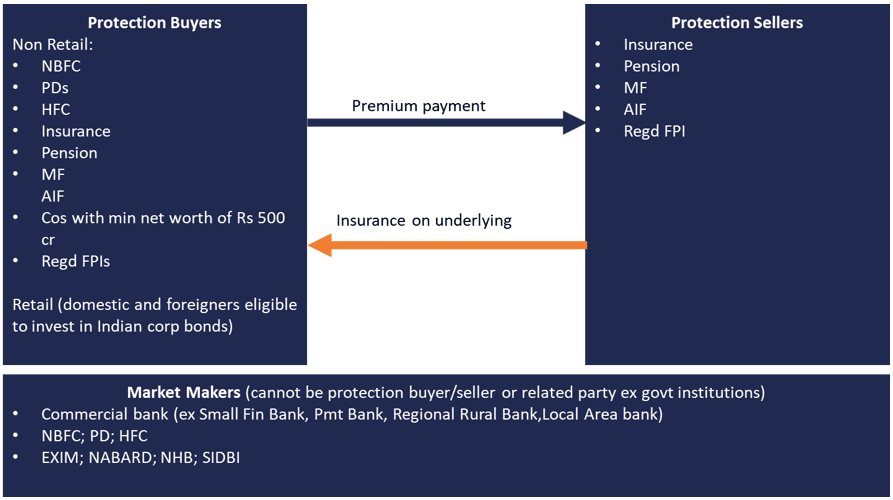

These directions relate to issuances of Credit Default Swaps (CDS). RBI aims to utilize credit derivatives as an additional tool to market participants to transfer and manage credit risk effectively by redistributing the underlying risk. CDS is a credit derivative contract where the protection seller commits to pay the protection buyer in case of a predefined credit event related to a debt instrument (reference entity). In return, the protection buyer pays a periodic premium to the protection seller until the contract matures or the credit event is triggered, whichever is earlier.

Participants

Participation of MFs, Insurance companies, Pension companies and AIFs are subject to directives from their corresponding regulators.

Product Scope:

INR debt instruments on which CDS can be issued (reference entity):

- Money market debt instruments (commercial papers, certificate of deposits, NCDs of original and residual maturity upto 1 year.

- Rated INR corporate bond and debenture

- Unrated corporate bond and debenture issued by SPVs set up by Infra companies

- Single name CDS allowed only (underlying is a single debt instrument)

- ABS and MBS not allowed.

Usage limitations:

- Retail protection buyers are only allowed to hedge exposures against credit risk.

- Non retail protection buyers are not restricted to just hedging needs.

Key differences with the Directions in 2011

| 2011 | 2022 | |

|---|---|---|

| Protection Buyers | Banks, PD, NBFC, MF, Insurance, HFC, Pension, Listed Corps, FIIs | PD, NBFC, MF, Insurance, HFC, Pension, AIF, Corps with min NW of Rs 500 cr, Retail, FPIs. |

| Protection Sellers | Banks, PDs, strong NBFCs, Insurance, MF | Insurance, Pension, AIF, MF, FPI |

| Market Makers | Stricter prudential norms. Banks, PDs, NBFCs | Relaxed prudential norms. Commercial Banks (ex SFB, PB,RRB,LAB), PDs,NBFCs, HFCs, EXIM, NABARD, SIDBI |

| Usage Restriction | Only for hedging | For retail, only for hedging. For non-retail, no such restriction. |

| Underlying instrument | Listed corporate bond, unlisted corporate bond by infra co, unlisted/unrated corp bond by SPV of Infra co. | Money market debt instruments, listed corp bonds, unlisted corp bonds by SPVs of infra cos. |

Source: RBI Guidelines on Credit Default Swaps (CDS) for Corporate Bonds, 2011; Reserve Bank of India (Credit Derivatives) Directions, 2022

Key differences with the Directions in 2011

| 2011 | 2022 | |

|---|---|---|

| Protection Buyers | Banks, PD, NBFC, MF, Insurance, HFC, Pension, Listed Corps, FIIs | PD, NBFC, MF, Insurance, HFC, Pension, AIF, Corps with min NW of Rs 500 cr, Retail, FPIs. |

| Protection Sellers | Banks, PDs, strong NBFCs, Insurance, MF | Insurance, Pension, AIF, MF, FPI |

| Market Makers | Stricter prudential norms. Banks, PDs, NBFCs | Relaxed prudential norms. Commercial Banks (ex SFB, PB,RRB,LAB), PDs,NBFCs, HFCs, EXIM, NABARD, SIDBI |

| Usage Restriction | Only for hedging | For retail, only for hedging. For non-retail, no such restriction. |

| Underlying instrument | Listed corporate bond, unlisted corporate bond by infra co, unlisted/unrated corp bond by SPV of Infra co. | Money market debt instruments, listed corp bonds, unlisted corp bonds by SPVs of infra cos. |

Source: RBI Guidelines on Credit Default Swaps (CDS) for Corporate Bonds, 2011; Reserve Bank of India (Credit Derivatives) Directions, 2022

TruQuest is knowledge series launched by TruBoard Partners providing succinct updates and views on:

- Liquidity outlook

- India’s macro economic view

- Trends within the infrastructure, Real Estate and Renewable Energy sectors

- Impact analysis of new regulations and policies on lending and capital flow

Author: Debopam Chaudhuri, Head of Research and Ratings

+91-9819239926, dc@truboardpartners.com

Author: Debopam Chaudhuri

Head of Research and Ratings

+91-9819239926

dc@truboardpartners.com

Disclaimer

The data and analysis covered in this report of TruQuest has been compiled by TruBoard VT Pvt Ltd and its associates (TruBoard) based upon information available to the public and sources believed to be reliable. Though utmost care has been taken to ensure its accuracy, no representation or warranty, express or implied is made that it is accurate or complete. TruBoard has reviewed the data, so far as it includes current or historical information which is believed to be reliable, although its accuracy and completeness cannot be guaranteed. Information in certain instances consists of compilations and/or estimates representing TruBoard’s opinion based on statistical procedures, as TruBoard deems appropriate. Sources of information are not always under the control of TruBoard. TruBoard accepts no liability and will not be liable for any loss of damage arising directly or indirectly (including special, incidental, consequential, punitive or exemplary) from use of this data, howsoever arising, and including any loss, damage or expense arising from, but not limited to any defect, error, imperfection, fault, mistake or inaccuracy with this document, its content.