Negative spillovers of recent rise in oil prices on to India likely to remain limited

Oil prices rose by ~8% after Saudi Arabia led OPEC+ announced a surprise oil production cut on April 2, 2023. Voluntary production cuts by OPEC+ members amount to a total of 1.6 mbpd (million barrels per day), almost 2% of global oil demand.

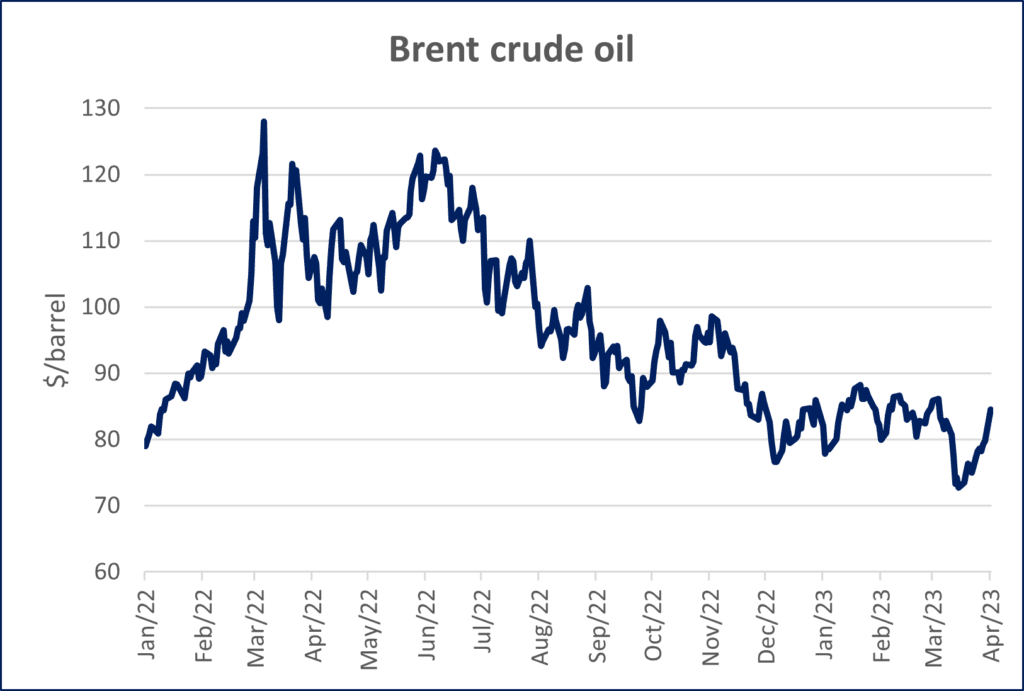

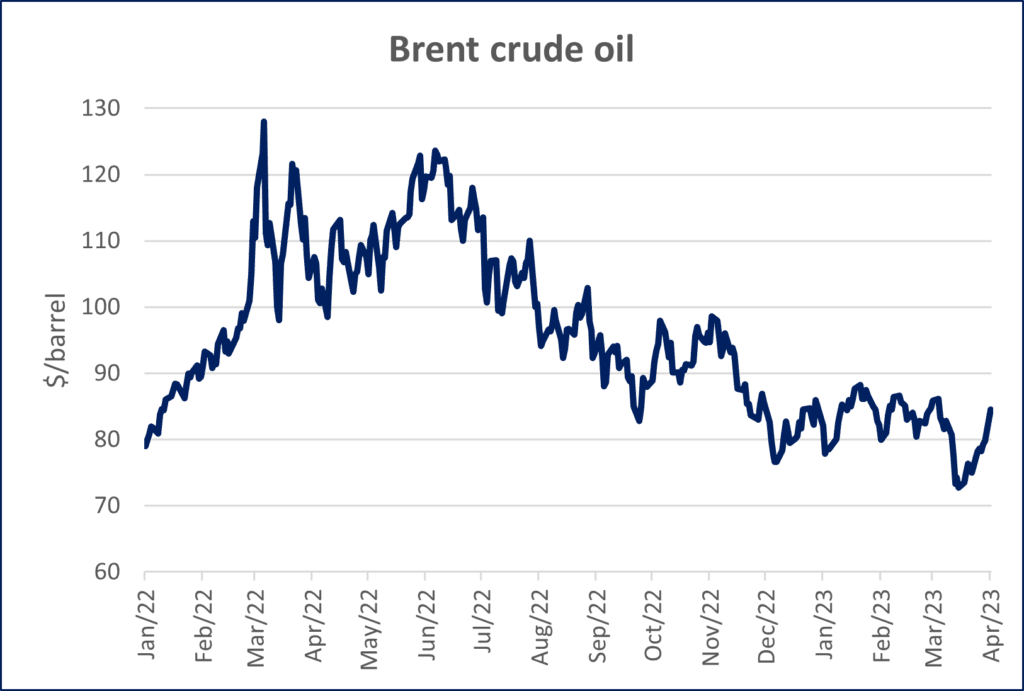

Oil prices spiked in 2022 in the aftermath of global economic recovery after the COVID pandemic and Russia-Ukraine war, touching $120 a barrel. Subsequently, high inflation across economies led central banks to hike rates aggressively, eventually leading to concerns over slowdown in global economy. The restart of Chinese economy in December 2022 too, could provide limited support to oil prices. March 2023 brought a new concern over global economic recovery with the collapse of SVB in the U.S. and ensuing banking stress. In Europe, Credit Suisse went in for a forced merger with UBS orchestrated by the Swiss authorities.

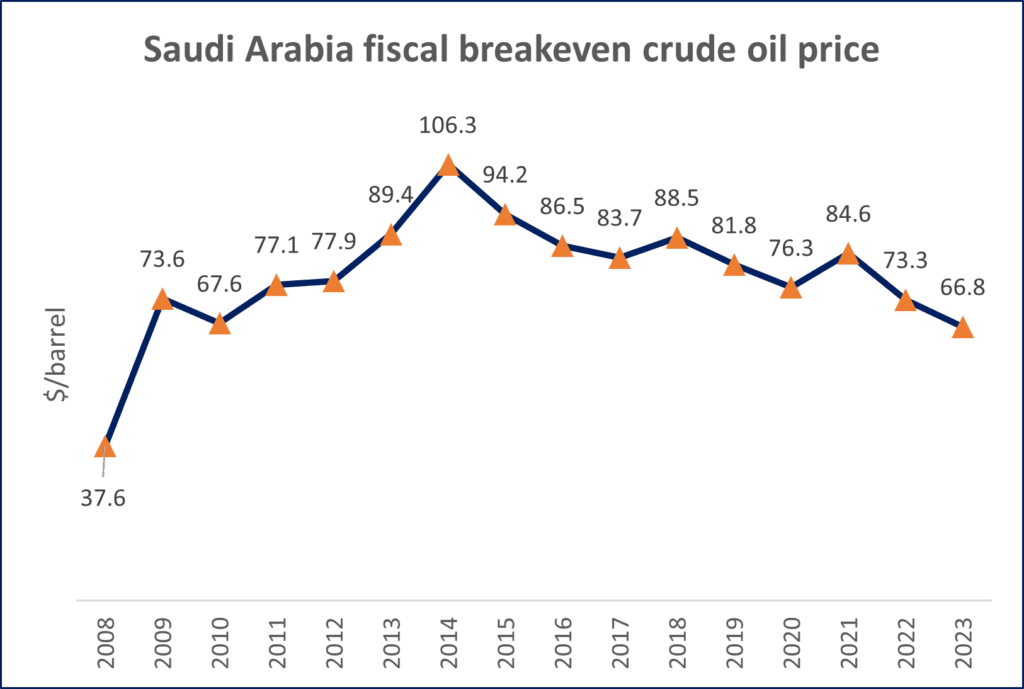

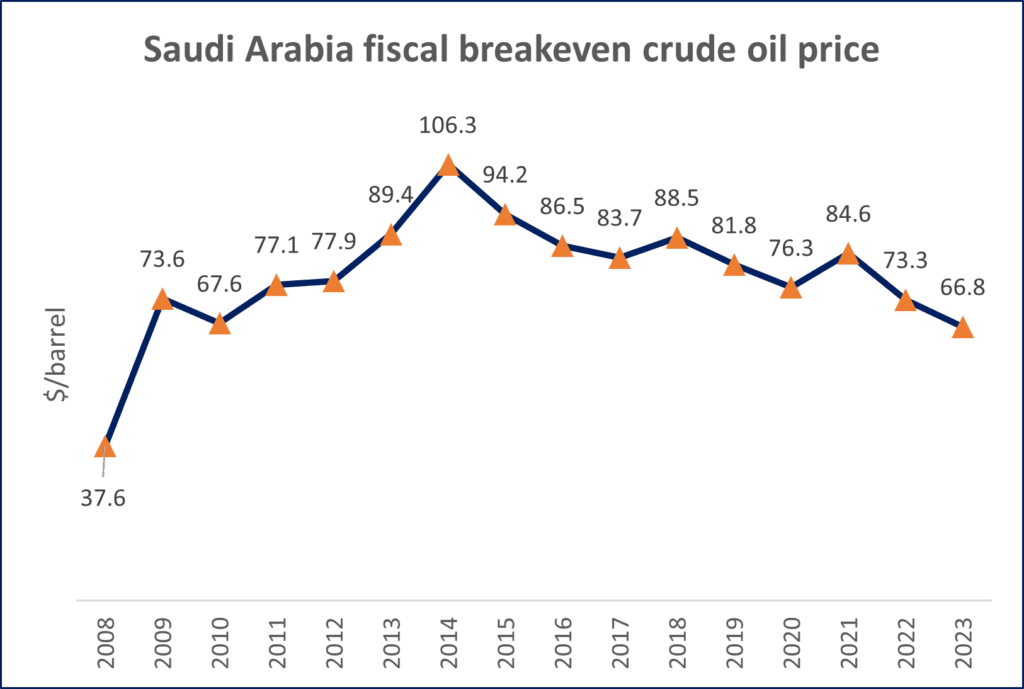

In 2023, brent crude price fell from its high of $88.2/bbl in January to $72.8/bbl in March. The current production cut by OPEC+ is in the light of concerns over global growth and weak oil demand. Moreover, Saudi Arabia isn’t too happy about the fact that the U.S. will replenish its reduced strategic reserves slowly over time. Major oil exporting nations (OPEC+) suffered a huge deal of loss in their oil export revenues as U.S. shale oil flooded the market and drove down prices in the previous decade. Moreover, the COVID pandemic reduced global oil demand by ~10%. While the OPEC+ nations have been following strategies to diversify their economies away from oil in recent years, currently oil still plays a major role. OPEC+ has been able to gain its pricing power back after almost a decade as Russian oil remains under sanctions, and U.S. shale seems to have peaked out. Investors in U.S. shale over the last few years have focused on returns and financial discipline as opposed to mindlessly increasing output.

The International Energy Agency (IEA) in March 2023 had projected global oil demand to grow by 2mbpd in 2023. This implied a deficit ranging 1-1.5 mbpd in the second half of this year before OPEC+’s new cuts. The actual deficit could now be more than this, provided the global economy stays on track. The IMF will release its updated economic outlook on April 5, 2023. In all likelihood, global growth outlook will be revised downwards from January 2023 estimates after factoring in the impact of recent banking crisis in Europe and the U.S.

Analysts are now looking at brent crude prices close to $100/bbl in the second half of CY’23. While the possibility of $100/bbl oil cannot be ruled out, a sudden and sharp increase seems unlikely given the fact that concerns over weak global growth dominate market sentiments. What could lead to a spike? Better than anticipated recovery in China, and an escalation in geo-political tensions.

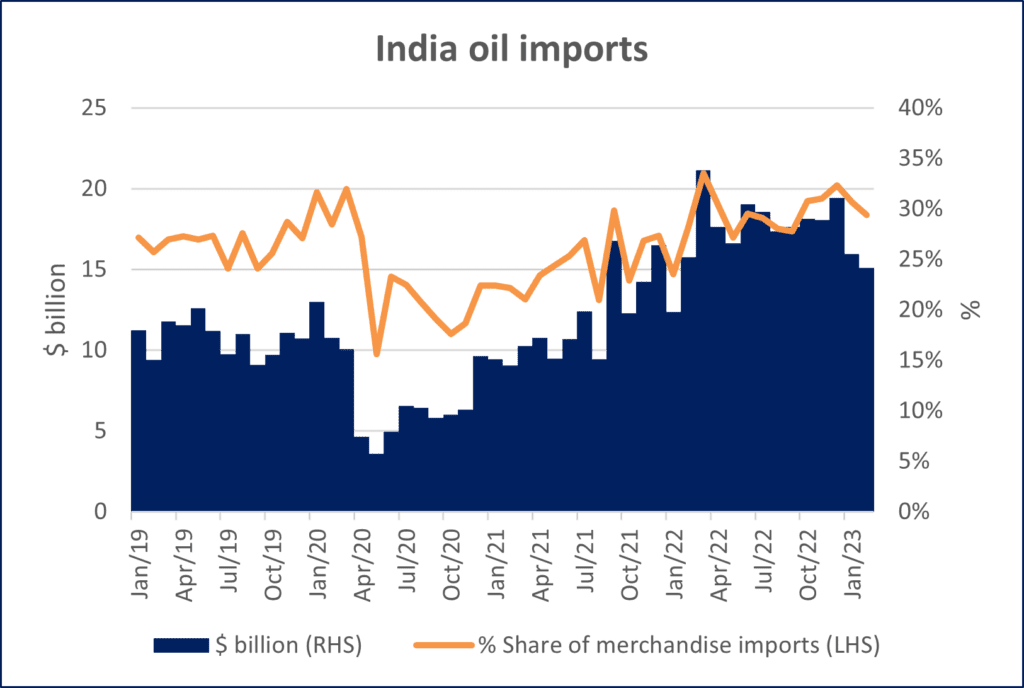

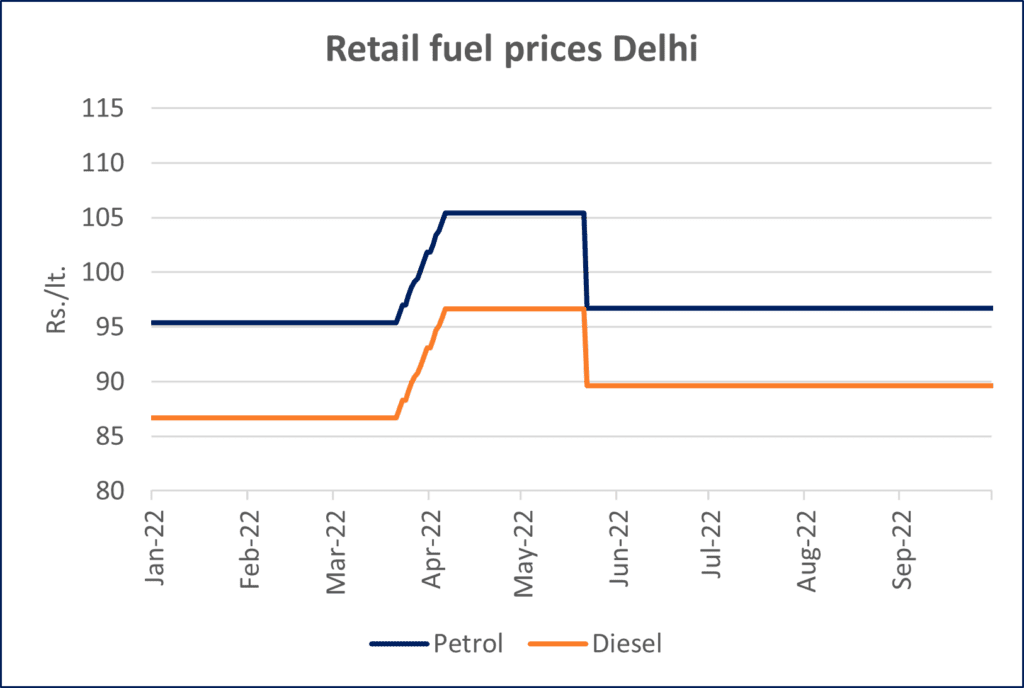

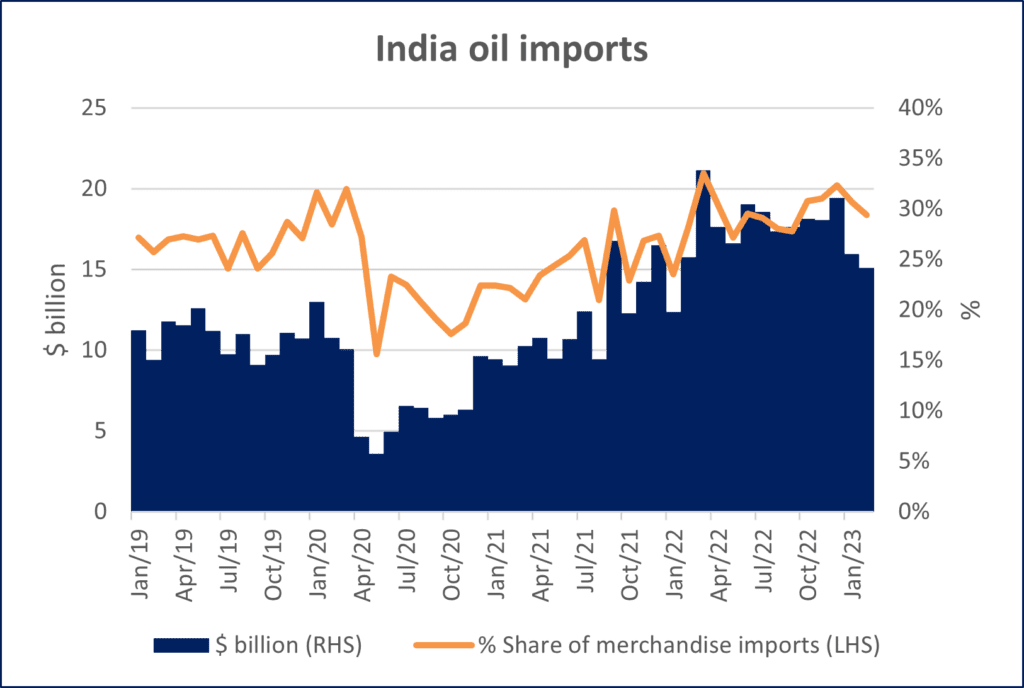

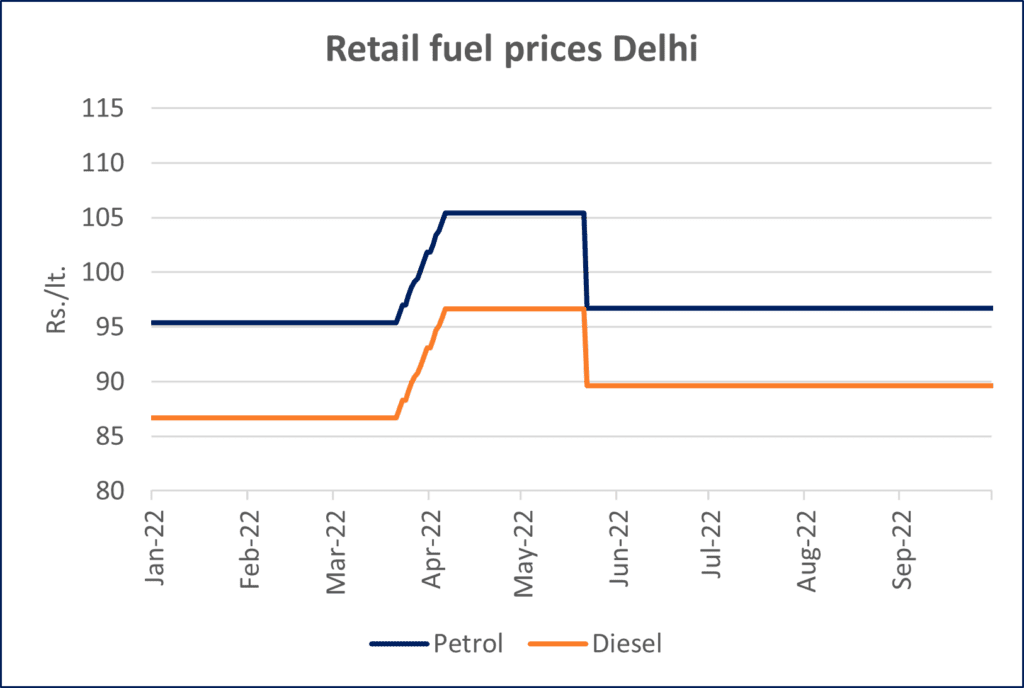

India imports ~5mbpd of crude. A $10 increase in price of crude oil can inflate India’s merchandise import bill by 4-5%. However, in recent months India has been importing major quantities of Russian crude oil, which is available at a 30% discount to international benchmarks. An increase in the price of crude oil impacts inflation via an increase in retail prices of petrol and diesel. However, retail price of petrol and diesel have remained unchanged since May-2022. A hike in retail prices in line with an increase in crude oil prices seems unlikely given the general elections in CY’24 and focus to bring down inflation. An increase would be absorbed by the Oil and Marketing Companies. Hence the impact of this recent increase in global crude oil prices on India is likely to be limited.

Oil imports make up almost a third of India’s merchandise imports

Retail fuel prices have remained unchanged since May 2022

Oil imports make up almost a third of India’s merchandise imports

Retail fuel prices have remained unchanged since

May 2022

Global oil prices have risen after the OPEC+

cut

Saudi is using output cuts to move oil prices away from its fiscal breakeven

Global oil prices have risen after the OPEC+

cut

Saudi is using output cuts to move oil prices away from its fiscal breakeven

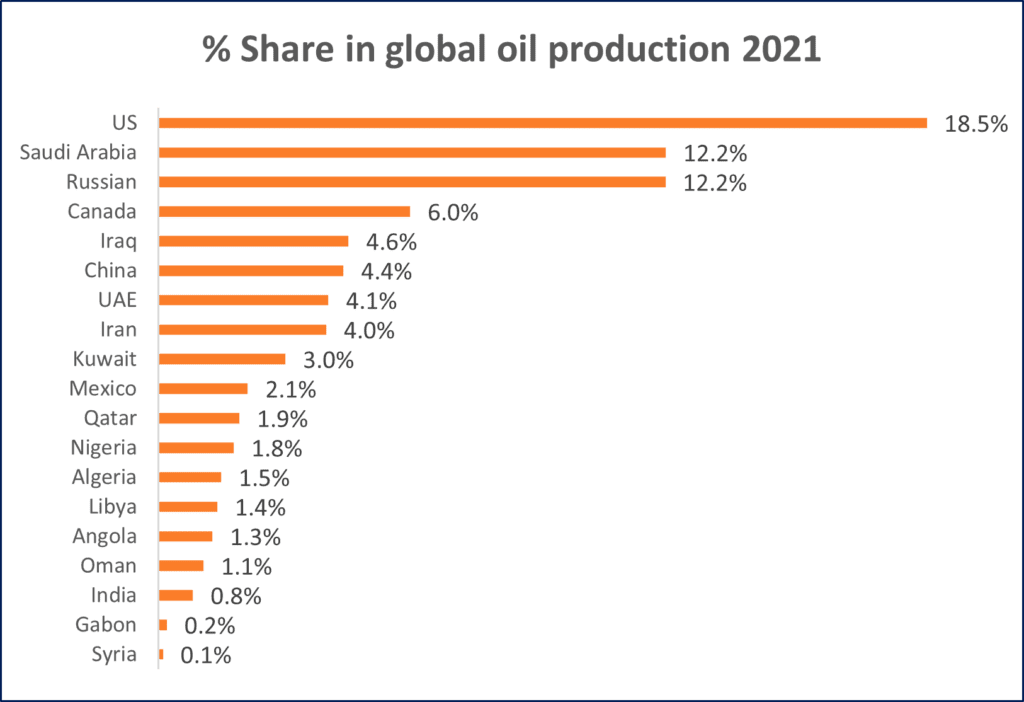

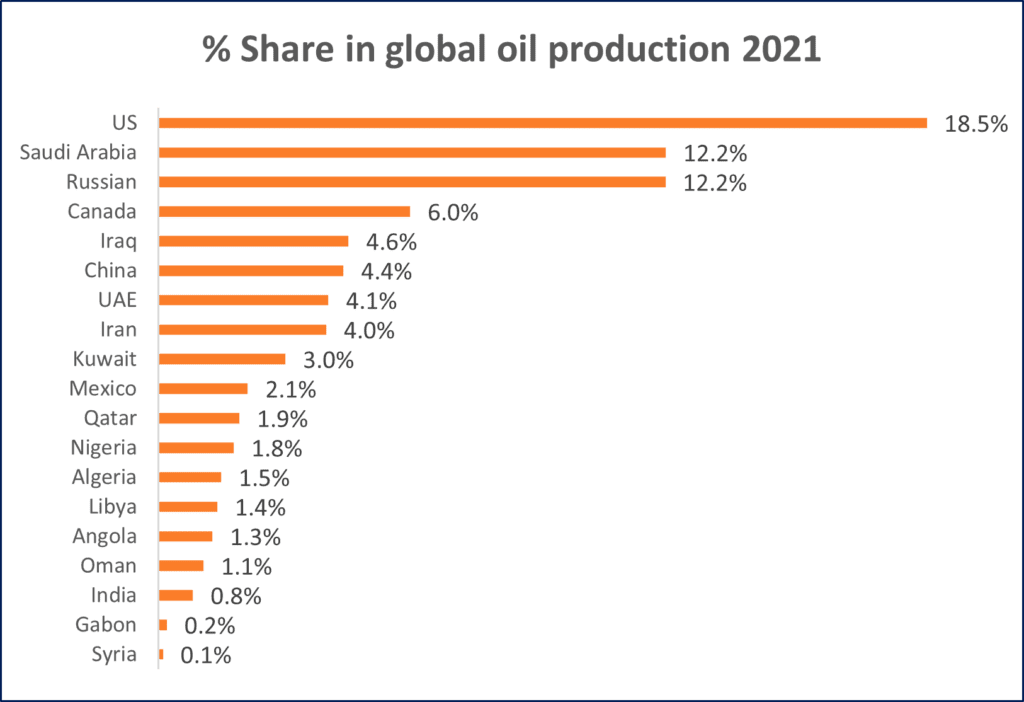

OPEC+ accounts for nearly half of global oil

production

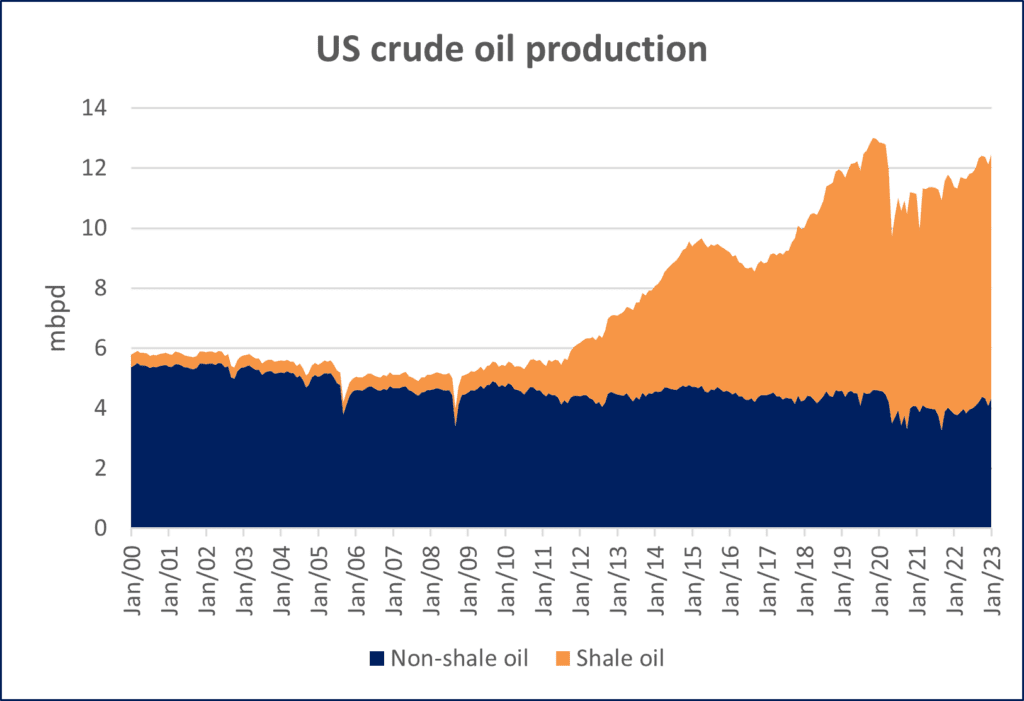

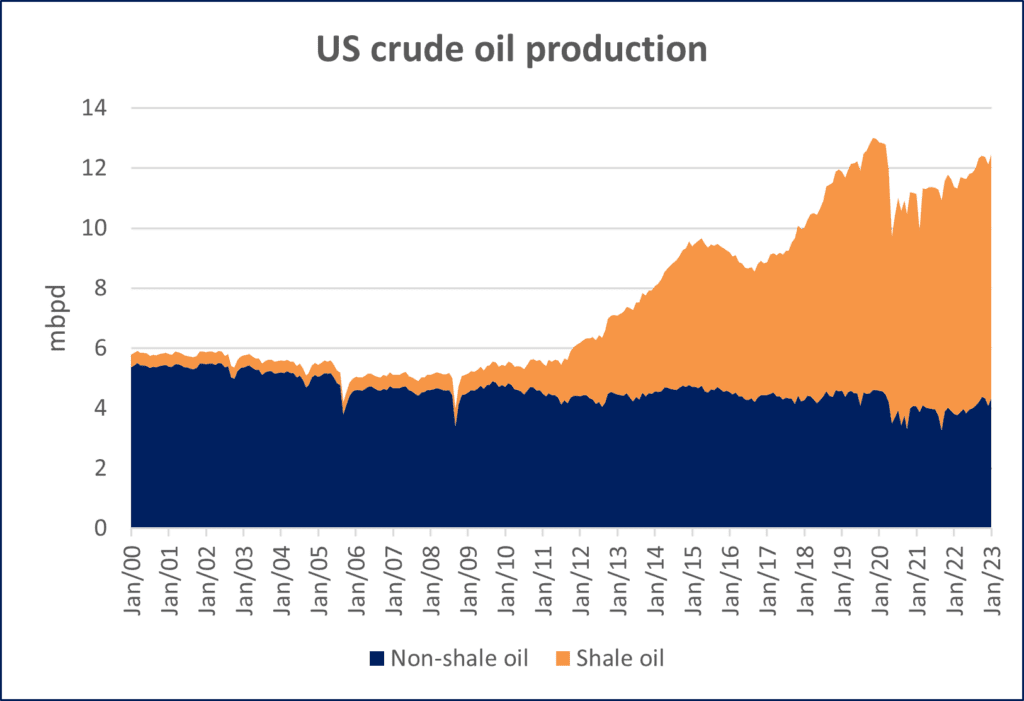

Shale oil has been the biggest contributor to increase in US oil production

OPEC+ accounts for nearly half of global oil

production

Shale oil has been the biggest contributor to increase in US oil production

Source: OPEC, IEA, EIA, CEIC, PPAC, BP, TruBoard

TruQuest is knowledge series launched by TruBoard Partners providing succinct updates and views on:

- Liquidity outlook

- India’s macro economic view

- Trends within the infrastructure, Real Estate and Renewable Energy sectors

- Impact analysis of new regulations and policies on lending and capital flow

Team:

Anuj Agarwal, Chief Economist

Ria Rattanpal, Research Associate

Author:

Anuj Agarwal, Chief Economist

Ria Rattanpal, Research Associate

Disclaimer

The data and analysis covered in this report of TruQuest has been compiled by TruBoard Pvt Ltd and its associates (TruBoard) based upon information available to the public and sources believed to be reliable. Though utmost care has been taken to ensure its accuracy, no representation or warranty, express or implied is made that it is accurate or complete. TruBoard has reviewed the data, so far as it includes current or historical information which is believed to be reliable, although its accuracy and completeness cannot be guaranteed. Information in certain instances consists of compilations and/or estimates representing TruBoard’s opinion based on statistical procedures, as TruBoard deems appropriate. Sources of information are not always under the control of TruBoard. TruBoard accepts no liability and will not be liable for any loss of damage arising directly or indirectly (including special, incidental, consequential, punitive or exemplary) from use of this data, howsoever arising, and including any loss, damage or expense arising from, but not limited to any defect, error, imperfection, fault, mistake or inaccuracy with this document, its content.