FY23 CPI forecast of 6.7%: Realism or tip of iceberg

- The Monetary Policy Committee did not choose to surprise the market this time and went ahead with a 50 basis points (bps) hike in policy repo rate, to 4.9%. Market sentiment was in favour of a 40-50 bps hike and no change in CRR.

- This hike automatically manifests in an upward shift in the Liquidity Adjustment Facility:

- Floor (Standing Deposit Facility or rate on overnight collateral free deposits with RBI) rises to 4.65% (from 4.15%)

- Ceiling (Marginal Standing Facility or emergency overnight lending by RBI to banks) rises to 5.15% (from 4.65%)

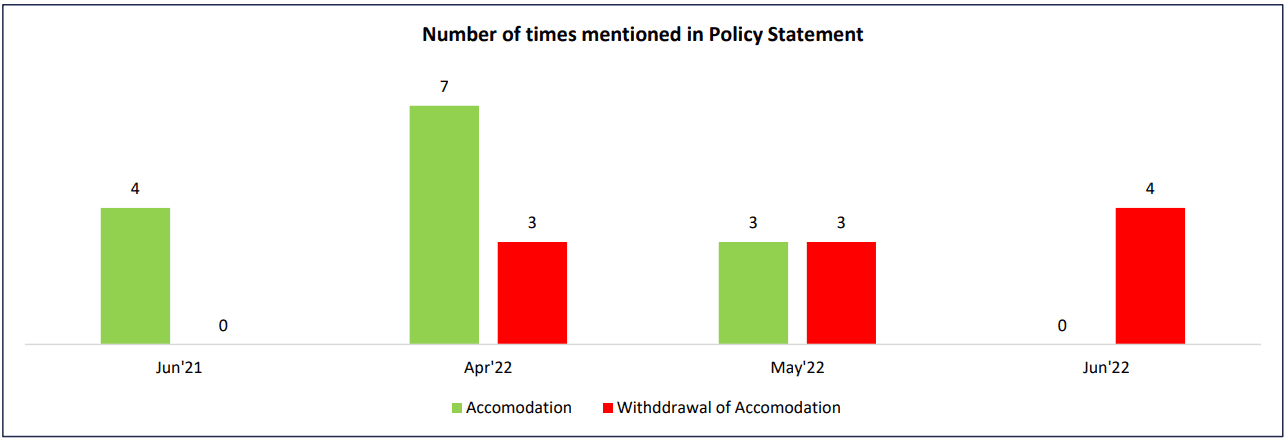

- In a significant departure from recent policies, the June policy statement completely abstained from suggesting any maintenance of accommodation. In-fact it dwelled more on “withdrawal of liquidity”. The chart below summarizes the shift in policy communication over time:

How to read the chart?

Interpreting monetary policy outlook involves an analysis of selection of words used by the policy makers. In this case, usage of the word “Accommodation” relates to maintaining a dovish policy, while “Withdrawal” suggests the extent of caution and sensitivity to switch to a neutral or hawkish stance in near future. The complete flip in times “Accommodation” and “Withdrawal of accommodation” were mentioned in the policy statements of Jun 2021 and Jun 2022 is a distinct signal that RBI’s accommodative/dovish stance has come to an end and the rate cycle is poised for a systemic upshift. We expect this to last for next 15-18 months, subject to the absence of any new black swan event.

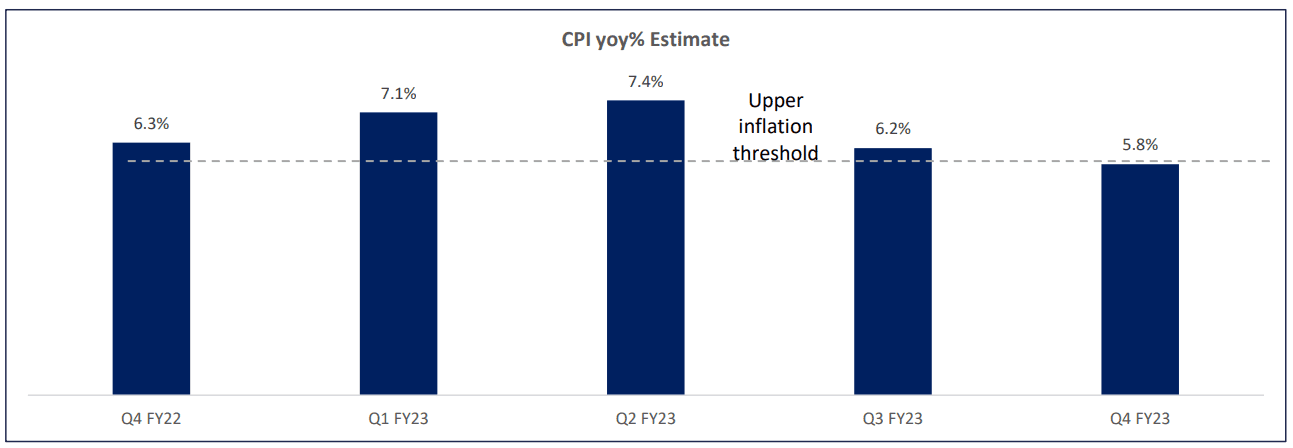

- This shift in outlook can be attributed to a sharp revision in inflationary expectations. While current inflation is largely due to external factors and volatile food basket, the MPC will have a difficult road ahead to adhere to its mandate on managing inflation. As per Central Government’s Official Gazette 4,”…factors that constitute failure to achieve the inflation target: (a) the average inflation is more than the upper tolerance level of the inflation target for any three consecutive quarters; or (b) the average inflation is less than the lower tolerance level for ant three consecutive quarters.”

In this context, RBI’s expectation on the inflationary trend remaining above upper tolerance of 6% for at least 4 consecutive quarters will certainly put the MPC members on an aggressive path of rate hikes. We expect policy repo to rise till 6.5% in this current cycle before plateauing.

- Reasons cited for the augmented inflation outlook:

a)Russia-Ukraine war leading to a dramatic rise in global commodity prices.

b) Volatility in global financial markets.

c) Global stagflation concerns.

d) Indian electricity tariffs

e) Input cost pass-through

f) Recent spike in tomato prices

g) Crude price volatility

- Immediate market reaction:

The current move was priced in. Debt markets were comfortable with the 50-bps hike in policy rates. Bankers also got what they wanted in the form of no hike in Cash Reserve ratio (CRR). Major banks had requested RBI to not raise CRR and support the recent revival in credit growth, especially since surplus liquidity is steadily declining. As per RBI estimates today, post the May announcement, surplus liquidity with banking system dipped by ~Rs 2 Lakh crores.

| Previous close | Post Policy (11:30 AM IST | |

|---|---|---|

| USDINR | 77.78 | 77.64 |

| 10 Yr GSEC%(benchmark) | 7.52 | 7.45 |

| O/N Call Rate% (wtd) | 4.11 | 4.55 |

| Nifty 50 | 16,584 | 16,570 |

| Previous close | Post Policy (11:30 AM IST | |

|---|---|---|

| USDINR | 77.78 | 77.64 |

| 10 Yr GSEC%(benchmark) | 7.52 | 7.45 |

| O/N Call Rate% (wtd) | 4.11 | 4.55 |

| Nifty 50 | 16,584 | 16,570 |

TruQuest is knowledge series launched by TruBoard Partners providing succinct updates and views on:

- Liquidity outlook

- India’s macro economic view

- Trends within the infrastructure, Real Estate and Renewable Energy sectors

- Impact analysis of new regulations and policies on lending and capital flow

Author:

Debopam Chaudhuri, Head of Research and Ratings

Ria Rattanpal, Research Associate

91-9819239926, dc@truboardpartners.com

Author:

Debopam Chaudhuri, Head of Research and Ratings

Ria Rattanpal, Research Associate

+91-9819239926

dc@truboardpartners.com

Disclaimer

The data and analysis covered in this report of TruQuest has been compiled by TruBoard Pvt Ltd and its associates (TruBoard) based upon information available to the public and sources believed to be reliable. Though utmost care has been taken to ensure its accuracy, no representation or warranty, express or implied is made that it is accurate or complete. TruBoard has reviewed the data, so far as it includes current or historical information which is believed to be reliable, although its accuracy and completeness cannot be guaranteed. Information in certain instances consists of compilations and/or estimates representing TruBoard’s opinion based on statistical procedures, as TruBoard deems appropriate. Sources of information are not always under the control of TruBoard. TruBoard accepts no liability and will not be liable for any loss of damage arising directly or indirectly (including special, incidental, consequential, punitive or exemplary) from use of this data, howsoever arising, and including any loss, damage or expense arising from, but not limited to any defect, error, imperfection, fault, mistake or inaccuracy with this document, its content.