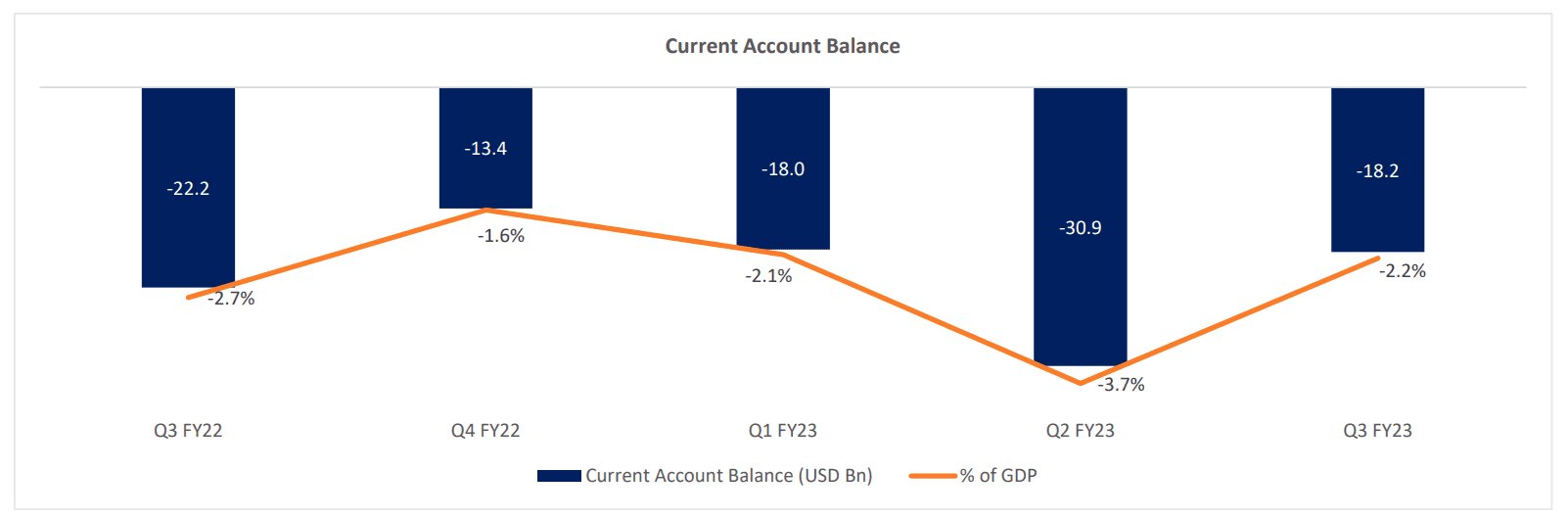

CAD shrinks to 2.2% of GDP as trade deficit narrows further

Current account deficit narrowed to USD 18.2 Bn (2.2% of GDP) in Q3 FY23 compared to USD 30.8 Bn (3.7% of GDP) in Q2 FY23. The current account deficit for September quarter was revised downward from USD 36.4 Bn estimated in its release in December’22.

The narrowing of current account deficit comes against a backdrop of narrowing goods and services trade deficit (USD 34 Bn in Q3 FY23 vs 43.8 Bn in Q2 FY23).

Narrowing Trade Deficit

The merchandise trade deficit narrowed to USD 72.7 Bn in Q3 FY23 compared to USD 78.2 Bn in Q2 FY23. While merchandise exports fell USD 6.3 Bn (USD 105.6 Bn in Q3 FY23 compared to USD 112 Bn in Q2 FY23) on account of weakening global demand, merchandise imports fell at a faster pace of USD 11.8 Bn (USD 178.3 Bn in Q3 FY23 compared to USD 190.2 Bn in Q2 FY23). Non-oil and non-gold imports witnessed a 7% decline (on-quarter), from USD 114 Bn in Q2 FY23 to USD 106 Bn in Q3 FY23. This signals some slowdown in domestic economic activity.

Net receipts within services trade, however, remained in surplus at USD 38.7 in Q3 FY23 compared to USD 34.4 in Q2 FY23 led by inflows in travel and construction, owing to healthy global economic recovery post Covid.

Investment Income dwindles, while workers’ remittances rescue

Deficit in the primary income account (largely representing investment income) widened further this quarter to USD 12.7 Bn from USD 11.8 Bn previous quarter. This is largely on account of repatriation of profits and debt servicing. Net remittances increased sharply to USD 28.4 Bn compared to USD 24.9 in the previous quarter. Almost a third of remittances into India come from the Middle East countries. High global energy prices of 2022 in part supported the strong inflows from these countries.

Outlook

A weak global growth outlook will weigh down on India’s exports, but at the same time soften commodity prices and reduce India’s import bill. Indian exports also stand to benefit from the China+1 sentiment. Service exports are likely to sustain their momentum as India offers a low-cost option for many global corporations. Despite being projected to grow at 6.1% (by the IMF) in FY24, India remains the fastest growing major economy. This will keep foreign capital hooked on to India. India’s balance of payments situation is likely to remain healthy in the coming quarters. Risks emanate from a spike in commodity prices (worsening geo-political dynamics, China recovery) and increase in risk-off sentiments triggered by intensification of banking crisis in Europe and US.

We expect the Indian rupee to perform much better in FY24 Vs FY23 on account of sustained momentum in domestic economic growth, moderation in risk-off sentiment leading FPIs to turn net buyers and a likely pause in rate hikes by advanced economies by the middle of the current fiscal year.

Source: RBI, TruBoard Research

TruQuest is knowledge series launched by TruBoard Partners providing succinct updates and views on:

- Liquidity outlook

- India’s macro economic view

- Trends within the infrastructure, Real Estate and Renewable Energy sectors

- Impact analysis of new regulations and policies on lending and capital flow

Team:

Anuj Agarwal, Chief Economist

Ria Rattanpal, Research Associate

Author:

Anuj Agarwal, Chief Economist

Ria Rattanpal, Research Associate

Disclaimer

The data and analysis covered in this report of TruQuest has been compiled by TruBoard Pvt Ltd and its associates (TruBoard) based upon information available to the public and sources believed to be reliable. Though utmost care has been taken to ensure its accuracy, no representation or warranty, express or implied is made that it is accurate or complete. TruBoard has reviewed the data, so far as it includes current or historical information which is believed to be reliable, although its accuracy and completeness cannot be guaranteed. Information in certain instances consists of compilations and/or estimates representing TruBoard’s opinion based on statistical procedures, as TruBoard deems appropriate. Sources of information are not always under the control of TruBoard. TruBoard accepts no liability and will not be liable for any loss of damage arising directly or indirectly (including special, incidental, consequential, punitive or exemplary) from use of this data, howsoever arising, and including any loss, damage or expense arising from, but not limited to any defect, error, imperfection, fault, mistake or inaccuracy with this document, its content.